Client Alert: SBA Proposes New Rule To Increase Receipts-Based Size Standards

Date: September 8, 2025

Size standards for small businesses are measured by either a company’s gross receipts (“receipts-based standard", usually applicable to the service industries) or by the number of a company’s employees (“employee-based standard,”) usually applicable to manufacturing companies. The U.S. Small Business Administration (SBA) recently (August 22, 2025) published a proposed rule increasing NAICS code caps for receipts-based small businesses. The SBA reviews size standards every five years to determine if certain NAICS codes have to be adjusted to keep up with inflation and other marketing trends.

In this proposed rule, the SBA increased the size standards for NAICS codes in about 250 industries while leaving the NAICS codes for about 230 industries unchanged. The biggest takeaway in the proposed rule is that many small businesses that were and are just above the size standard will either stay classified as “small” or become “small” again under the new size standards. This may have serious implications on whether a company wants to sell or acquire an entity as a small business, not to mention eligibility for small business set-aside contracts, small business loans and other assistance programs.

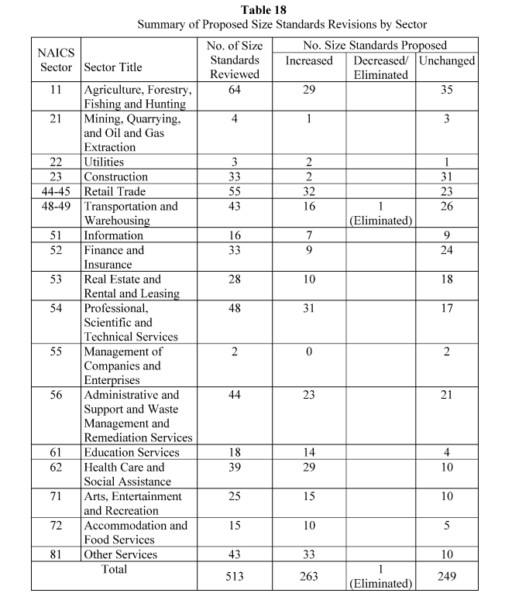

Please note, however, that this is a proposed rule and not yet a final rule. The comment period ends on October 21, 2025. For a quick general overview, the SBA provided the table below. If you need to see the proposed rule in its entirety to determine if it affects your client, or if you have any other questions, please contact Ralph Thomas at rthomas@whitefordlaw.com.

The information contained here is not intended to provide legal advice or opinion and should not be acted upon without consulting an attorney. Counsel should not be selected based on advertising materials, and we recommend that you conduct further investigation when seeking legal representation.